They are large white boxes, resembling cargo vans, and they are now at the center of the technology conflict between the United States and China.

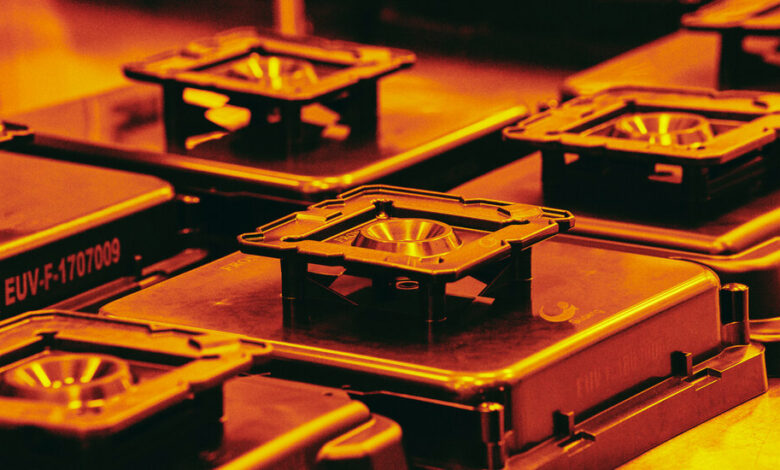

The lithography machines, which are used to print complex circuitry on computer chips, have become a crucial choke point as the United States attempts to slow down China’s progress in technology that could benefit its military.

While these machines are crucial for China’s chip-making industry, the country does not currently have the technology to produce them in their most advanced forms. This week, the U.S. government took steps to impede China’s efforts by prohibiting companies worldwide from sending certain types of chip-making machines to China without a special license.

This move could have a significant impact on China’s chip-manufacturing ambitions and represents an unusual exercise of American regulatory power. U.S. officials assert that they have the authority to regulate equipment manufactured outside the United States if it contains even just one American-made part.

This decision gives U.S. officials new control over companies in the Netherlands and Japan, where some of the most advanced chip machinery is made. Particularly, U.S. rules will now hinder shipments of certain machines that utilize deep ultraviolet (DUV) technology, primarily produced by Dutch firm ASML, a dominant player in the lithography market.

Vera Kranenburg, a China researcher at the Clingendael Institute, a Dutch think tank, noted that ASML had made it clear that it would comply with the regulations but expressed dissatisfaction with previous regulations that prohibited the export of a more advanced lithography machine to China.

ASML, in its response, stated that it complies with all laws and regulations and acknowledged that it would not be able to ship certain tools to a few Chinese chip factories, which would result in a decline in sales.

In response to the new export restrictions, the Dutch foreign trade minister stated that the Netherlands shares U.S. security concerns but emphasized that each country has the right to impose their own export restrictions.

The precision of ASML’s machines has revolutionized global computing power, enabling the packing of more computing power into smaller chips. This technology has become a pivotal leverage against China in terms of military advantage.

While the United States and its allies see China as a geopolitical and economic threat, there are concerns about undermining their own companies by cutting them off from the vast tech market in China.

The Dutch technology industry has faced increasing pressure from the United States. In 2019, the Trump administration convinced the Dutch government to block shipments of ASML’s most advanced machine to China. In January, the governments of the Netherlands and Japan agreed to independently restrict sales of certain lithography machines and other advanced chip-making equipment to China.

Although sales of deep ultraviolet lithography machines are seen as less of a national security risk compared to the most cutting-edge machines, a Chinese firm’s use of ASML’s technology to surpass a technological barrier raised concerns.

The United States recognized the need for updated controls to restrain China’s advanced chip-making capabilities, despite ASML’s ongoing business with China. The new restrictions are expected to have a significant impact on ASML’s revenues from China.

The restrictions will not immediately break China’s most advanced chip-makers, but it will greatly limit their ability to manufacture the most advanced semiconductors, such as seven-nanometer chips.

ASML’s chief financial officer stated that most of the orders completed this year were placed in 2022 or earlier and were for machines producing slightly older chip types. However, the new restrictions will prevent ASML from supplying replacement parts and servicing the restricted systems, which will eventually lead to manufacturing issues for Chinese companies.

ASML is not the only equipment supplier affected by the new rules. Applied Materials and Lam Research, both U.S. companies, are among the other essential suppliers targeted in the latest export restrictions.

Even with potential revenue reductions, ASML’s China sales are expected to be substantial this year, but the new export controls could have a larger impact next year.

The development of expensive lithography machines used in chip-making has become a contentious issue in the U.S.-China conflict. The United States is leveraging its technological advantage to slow down China’s progress in the industry, primarily through export restrictions. This puts significant pressure on companies like ASML, which dominate the market for these machines. The conflict highlights the intersection of technology, national security, and economic competition between the two global powers.

Contributed by WealthNationUSA